Self-Funded Cooperatives

Self-Funded Cooperatives

A self funded cooperative is just another intergovernmental agreement for public entities. It should be a financial vehicle to control and stratify claims costs, yet be flexible to accommodate different plan designs and bring a level of control that is rarely available in fully insured and self funded annual insurance contracts.

This is a long term vehicle meant be budgetable, stable and predictable.

Your managing partners which would include Mark III will also include legal, accounting, auditing and recordkeeping resources.

The best part of your experience is a cooperative is the ability to make decisions as an owner/partner of the cooperative rather than a customer of an insurance company.

Why your public entity should be…

- Transparency is all cost elements

- Plan design flexibility

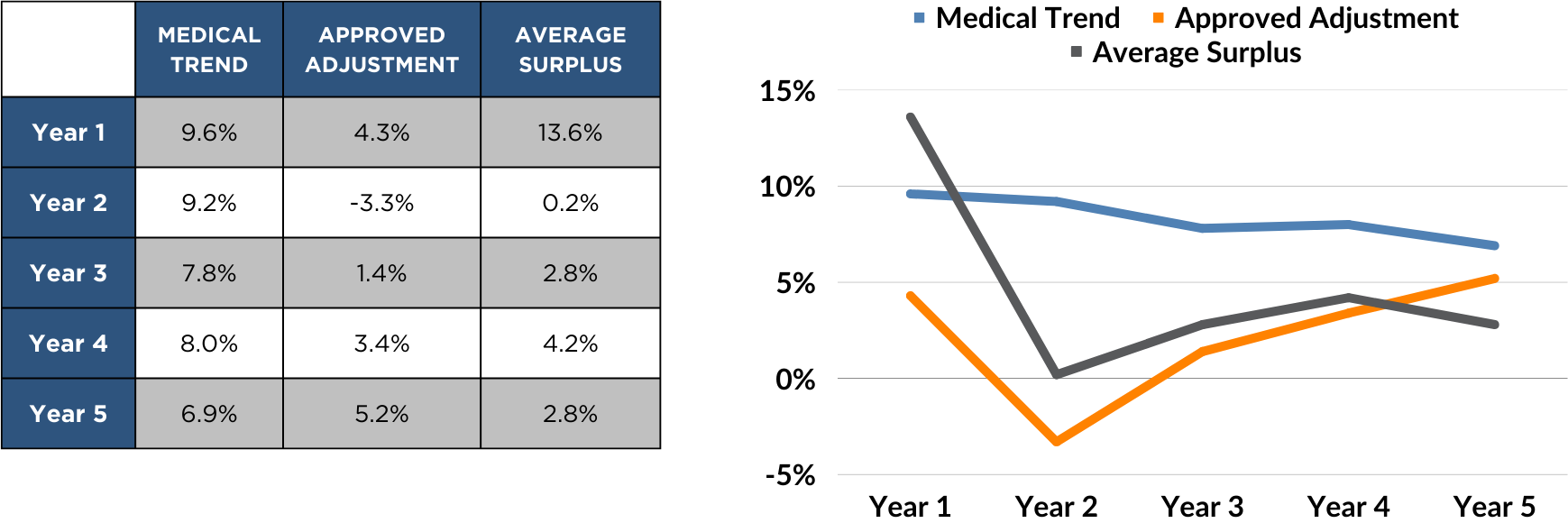

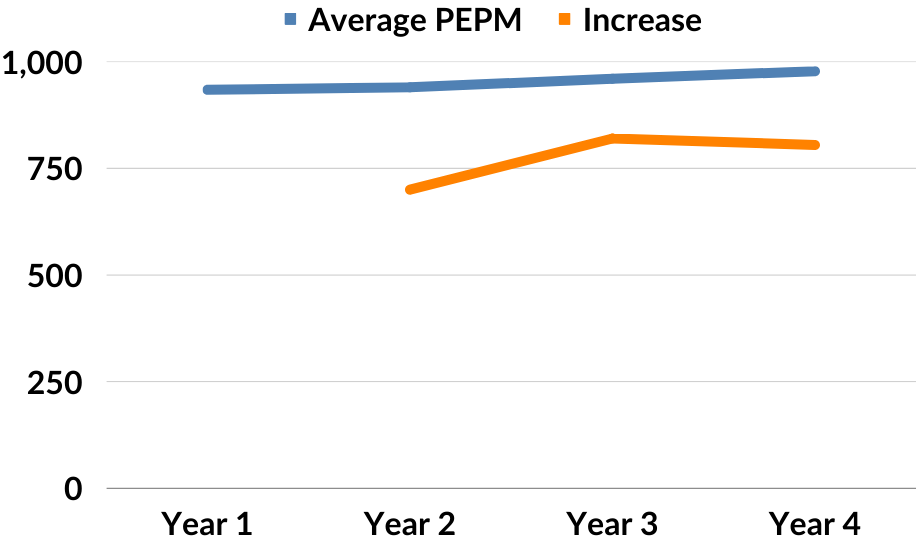

- Proven track record of annual adjustments in the single digits

- Enhanced contract language

- Mitigation of risk elements to create stability

- Budget integrity annually

- Owner/partner status

How to start a co-oP

-

- Gauge public entity interest

- Secure participation of insurance network, Rx program and stop loss

- Develop legal documents according to state laws and regulations

- Design cash flow through accounting firm to handle the cooperative financial obligations

- Provide necessary underwriting protocols to maintain standard of budgetable, stable and predictable

- Provide quotes to all interested parties

- Support public entity management to secure board/council approval

How to Maintain a Co-Op

-

- Provide ongoing service on a macro basis to the cooperative and micro basis to each public entity

- Commit to quarterly meetings of the cooperative to discuss financial results and operational issues

- Solicit new membership to be voted on by existing members

- Promote the cooperative through participation in public entity conferences

- Consultants to stay abreast of changing dynamics in the insurance marketplace and provide the cooperative with advice

- Consider bringing the cooperative choices that mirror a “best of the best” mentality

Results

Success Stories

Illinois Co-Op – 115 Public Entities, 14,000 Employees

North Carolina Co-Op – 16 Public Entities, 7,000 Employees

Wholesale, Co-Broker Opportunities

In states, where Mark III does not have a definitive presence, we will consider working with brokers/consultants with a presence in the public sector marketplace looking to build a cooperative to better control costs, achieve greater persistency and give their clients/prospects a “cutting edge” solution.

- Mark III will work with your organization building the cooperative based on the tabs above

- We will educate your staff on how to now focus longer term rather than always a 12 month focus

- We will teach your staff how the insurance relationship, client relationship and primary vendors relationship becomes a partnership

- We will initially work with vendors that have market share and your firm feels the most comfortable working with

- We will work on a consulting fee basis until the cooperative is up and running, subsequently we will share in the revenue generated for a period certain

- We will show you how to elevate your firm’s profile in the public entity space.

Testimonials

What They’re Saying

“Gregg Aleman was the lead consultant and person responsible for developing the Pool’s state-of-the-art organizational strategy and financial structure necessary for success. To this day, the IPBC’s members benefit from a cost-predictable model that conventional health plans cannot match.

Mr. Aleman’s knowledge, creativity and professionalism were major keys to the success of the IPBC during my many years served as treasurer of the organization.”